Quarterly Economic Update Third Quarter 2024

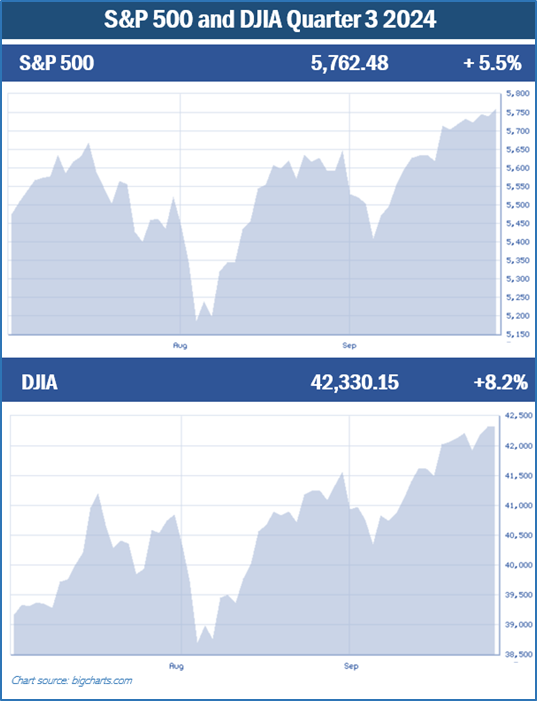

If you heard that the war in Ukraine would continue, unrest would heighten in the Middle East, a former President would be shot during a contentious Presidential election season, and the Federal deficit would reach an all-time high, you might think that the equity market would struggle. Fortunately, for long-term investors, the first three quarters of 2024 have been recorded as the best first three quarters of any year in the 21st century. While the third quarter had its ups and downs, the S&P 500 rose 5.5% and closed the quarter at an all-time high of 5,762. This brought the S&P 500’s year-to-date gain to nearly 21%. The Dow Jones Industrial Average (DJIA) also had a record performance, rising 8.2% for the quarter, ending at 42,330. This brought the DJIA’s year-to-date gain to over 12%. (barrons.com/market-data)

The third quarter was not a smooth ride by any means. As you can see from the charts, investors had a roller coaster ride, and volatility remained a main characteristic of an investor’s journey. August was the S&P 500’s most volatile month in nearly two years after several factors, including weaker-than-expected jobs data for July, thus increasing recession concerns. However, equities regained most of their losses by the end of the month and, after taking another dip in early September, were once again in record-breaking territory by the end of the quarter.

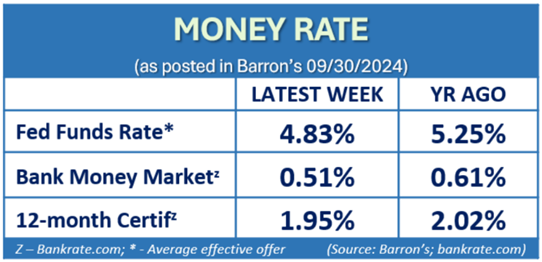

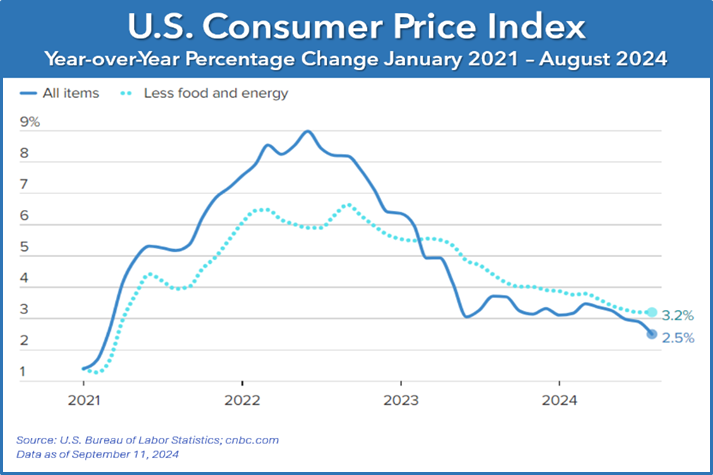

Inflation seems to be reduced to a reasonable rate after steamrolling the economy. In August, inflation slowed for the fifth consecutive month and continued to inch toward the Fed’s 2% goal. The Fed closely monitors the Consumer Price Index (CPI), which is a broad measure of goods and services costs, as one of the indicators for interest rate adjustments. In August, the year-over-year Consumer Price Index (CPI) was 2.5%. This rate is the lowest since February and below the forecast of 2.6%. The continued deceleration of inflation and favorable key economic indicators prompted the Fed to finally enact a much-anticipated interest rate decrease. In September, the Federal Funds interest rate range was reduced by a half percent, down to 4.75 – 5.00%.

Employment statistics are considered a strong measure of the economy's health. The August jobs report reflected that the labor market added 142,000 non-farm jobs. In August, the unemployment rate was 4.2%, higher than a year earlier when the jobless rate was 3.8%. While this is an uptick, unemployment reports continued to defy expectations. Many anticipated a significant rise in unemployment coupled with falling inflation. (Source: www.bls.gov)

With continued low unemployment rates combined with reduced inflation, the U.S. economy maintained its strength, and economic activity continued to expand, even during this relatively rapid disinflationary period.

In September, the Energy Price Index was down 3.20% from August, and down 5.64% year-over-year. Gasoline, year-over-year, as of August, is down 10.3%. The average cost of regular gasoline at the end of September was approximately $3.20 compared to last September’s average of $3.85. California continued to have the highest average gas prices of approximately $4.65 per gallon, and Mississippi residents enjoy an average of $2.76 per gallon. (Sources: www.bls.gov/news.release; gasprices.aaa.com)

Shelter costs continued to strain consumers and as of August, are 5.2% higher year-over-year. Year-over-year, food at home rose 0.9%, while trips to a restaurant continued to be 4.0% higher in August. (Source: www.bls.gov/news.release)

Overall, the third quarter of 2024 was a favorable one for investors. With decreasing interest rates, investor sentiment remained optimistic. We are still enjoying a bull market. However, the fourth quarter brings elections and the potential for significant change. It is still wise to remain alert, cautious, and focused on one’s personal situation.

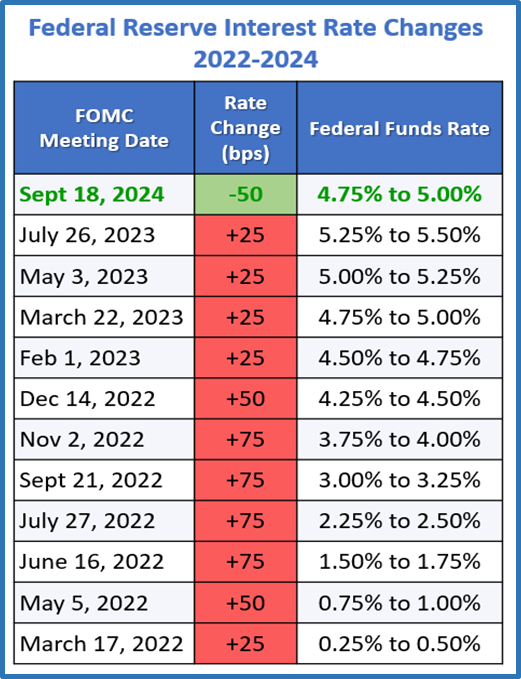

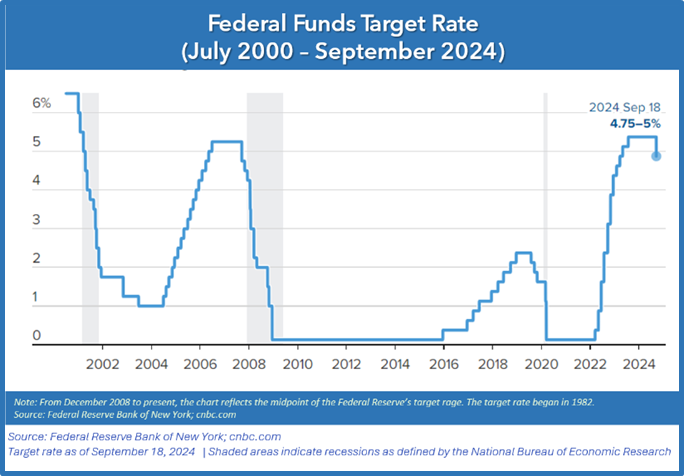

During two unscheduled meetings in March 2020, the Federal Reserve cut interest rates to cope with the pandemic-induced recession. Those two meetings resulted in a federal funds target rate range of 0 – 0.25%.

After two years of enjoying historically low rates, in March 2022, the rate range was increased to 0.25 – 0.50%. While the rate range was still extremely low, this increase was the first of many as the Federal Reserve began its campaign to fight high inflation. The Fed raised interest rates a total of eleven times, settling at 5.25 – 5.50% in July 2023. They finally started to reverse direction on September 18, 2024, by lowering rates to 4.75 – 5.00%. This much-awaited cut is the first rate cut since the onset of the pandemic and ended the 23-year high for interest rates. The rate cut was half a point, defying many expectations that the Fed would only reduce rates a quarter-point.

While inflation is still higher than the Fed’s goal of 2.0%, the Fed felt it appropriate to start cutting borrowing costs because the labor market, while still strong, was beginning to show signs of weakening.

The stock market responded very favorably to this rate cut. The DJIA reached a new record as it closed 1.3% higher and breached 42,000 for the first time. The S&P 500 rose 1.7%, also setting a new record, closing at over 5,700. (Source: cnn.com; 9/20/24)

In August, the year-over-year Consumer Price Index (CPI) was 2.5%. This is the lowest annual increase since February 2021, suggesting that the Fed’s coveted 2% rate could be in the near future.

The Core CPI (CPI excluding food and energy) was 3.2% year-over- year. This was slightly more than expected due to increased shelter and transportation service prices.

Starting the year, it was anticipated that we could see three rate cuts in 2024. As of the third quarter, we have only seen one rate cut. There are two more scheduled FOMC meetings in 2024. The Federal Reserve’s press release following the September meeting stated that the Committee “has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

The Fed’s economic forecast, released at the September FOMC meeting, suggested additional rate cuts this year, up from the single rate cut forecasted during the previous meeting. Fed Chair Jerome Powell stated during the September press conference that, “If the economy evolves as expected, the median participant projects that the appropriate level of the federal funds rate will be 4.4 percent at the end of this year and 3.4 percent at the end of 2025. These median projections are lower than in June, consistent with the projections for lower inflation and higher unemployment, as well as the changed balance of risks. These projections, however, are not a Committee plan or decision.”

The Fed is still committed to reaching a 2% inflation rate. When assessing the appropriate stance on monetary policy, the FOMC will continue to closely watch key indicators, including labor market conditions, inflation pressures, and financial and international developments.

Interest rates and inflation are integral to investors' financial planning, so we will continue to monitor any movements and stay apprised of key economic indicators.

The Bond Market and

Treasury Yields

Bond prices and interest rates have an inverse relationship. When interest rates go down, the price of bonds go up and vice versa. With more interest rate cuts forecast, what does this mean for bond investors? The window of opportunity could be narrowing quickly to get a lower-risk, higher-yielding bond.

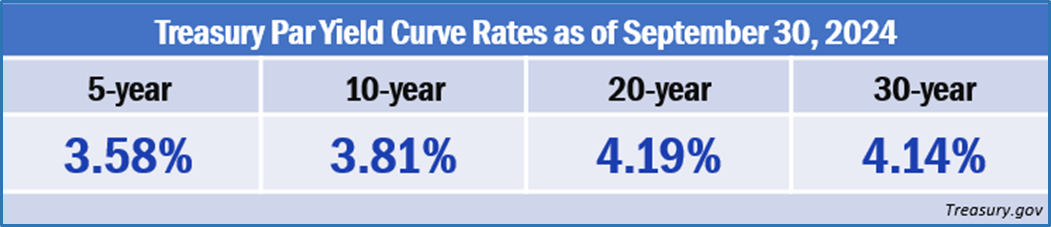

U.S. Treasury yields have shown a downward trend. The yield on the 10-year treasury note decreased, dropping from 4.48% at the beginning of the quarter to 3.81% on September 30. The shorter-term yields, such as the 2-year note, have also declined, signaling changing expectations regarding interest rates.

The decline in yields suggests that investors are seeking safer assets amid economic uncertainty, as well as a potential easing of the Federal Reserve’s monetary policy. The demand for bonds has increased as investors are seeking more stability, driving bond prices higher and pushing yields lower.

The long-running inverted treasury yield curve ended in September. The inversion began in 2022 and lasted for a record-breaking 793 days. An inverted yield curve occurs when short-term interest rates exceed long-term interest rates. While some feel an inverted yield curve is a key indicator of a recession, the economy has remained resilient and healthy.

The quarter opened with the benchmark 30-year yield at 4.64% and ended lower at 4.14%. The 20-year yield settled at 4.19%, notably lower than the opening of the quarter when it was 4.76%.

We will continue to closely monitor how the Fed’s movements affect bond yields. With the prospect of continued interest rate cuts on the horizon, the bond market may seek further shifts in demand and lower yields. Please get in touch with us if you are interested in adding bonds as part of a diversified portfolio. As your wealth manager, we want to help you make the best decision for your portfolio. While diversification in your portfolio can help you pursue your goals, it does not ensure a profit or guarantee against loss.

Investor’s Outlook

The S&P 500 and DJIA continued to create all-time highs in the third quarter, maintaining a strong year for investors so far. In fact, it was the best first three quarters of any year in the 21st century. Historically, the fourth quarter has been a strong one for equities, with the S&P 500 posting a more than 4% average gain from 1957 to 2022. (forbes.com, 9/30/24)

Although there is still a lot of uncertainty in the world and economy, we are still currently experiencing a bull market, which began in June 2023 after the S&P 500 rose 20% from its low in October 2022. Many investors are speculating about how long this bull market can last. While previous performance is not an indicator of future results, historically, the median bull market lasts about 46 months or 3.8 years. As of September, this current bull run is only 21 months old. (Source: Investopedia.com: 6/24)

While many analysts remain optimistic that we will continue to experience this record-breaking rally, several volatility-inducing events are waiting in the wings, including the U.S. elections and continued geopolitical risk. Volatility will continue to be a concern moving into the coming months.

Maintaining a long-term approach to investing should still be a benchmark for savvy investors. We will continue to focus on key factors that could affect your personal situation, including economic growth, inflation movement, monetary policy moves, and interest rate changes. Many continuing uncertainties surround the economic environment, including interest rates, the pace of inflation, and the pace of economic growth, and, of course, as mentioned, the 2024 U.S. presidential election. Although the current Presidential election is highly contentious, please remember that typically, economic and inflation trends affect equities markets more than election results. Because this is an unusually raucous election year, we cannot overlook the potential of a short-term election aftershock in the stock market.

Regardless of who is elected, both candidates have proposed changes in tax rules and economic policy that can directly affect investors, savers, retirees, and taxpayers. We are committed to keeping apprised of any changes we feel could affect your personal situation.

The Fed projections currently estimate another half-point rate cut in 2024 from the recently lowered range of 4.75 – 5.0%. Should inflation continue to decline and unemployment numbers rise, the projections further indicate that interest rates will drop another percentage point by 2025. In Chair Jerome Powell’s press conference on September 18, he stated, “As the economy evolves, monetary policy will adjust in order to best promote our maximum-employment and price-stability goals. If the economy remains solid and inflation persists, we can dial back policy restraint more slowly.”

Chair Powell stated, “The U.S. economy is in good shape. It's growing at a solid pace. Inflation is coming down. The labor market is in a strong place. We want to keep it there. That's what we're doing."

As interest rates move lower, consumers could experience the much-anticipated ease of strain on borrowing costs. For many, this could mean paying lower interest rates on auto and home loans, refinancing currently higher loans and mortgages, and tapping into home equity at a lower cost.

Currently, the U.S. economy continues to show signs of strength and resilience. Will we see the soft landing the Fed has worked so hard for? Have we steered away from a recession? While still a concern, it’s looking hopeful the Fed has deflected, at the least, a hard recession.

National Retail Federation Chief Economist Jack Kleinhenz stated, “The U.S. economy is clearly not in a recession nor is it likely to head into a recession in the home stretch of 2024. Instead, it appears that the economy is on the cusp of nailing a long-awaited soft landing with a simultaneous cooling of growth and inflation.” Positive inflation numbers will be critical to the Fed's confidence in continuing to cut rates.

Although investors have been pleasantly rewarded thus far in 2024, we continue to follow our mantra of “proceed with caution” over these coming months. Taking a long-term approach to equities and staying apprised of economic data could help you stay one step ahead of potential market volatility.

We believe that speculation is not a good strategy. Instead, staying vigilant and focused on your own well-devised, long-term personal situation is a wiser investment strategy. We also believe an educated client is the best client, and we strive to keep you updated on areas that could affect your situation.

Now, as always, is a time to stay focused on your personal objectives. One of our main goals is to help you create a solid financial strategy that considers your risk tolerance, time horizon, and potential tax implications.

As a reminder, focus on what you can control - which is your time horizon, your risk appetite, and emotional-investing behavior.

If you would like us to look at your financial situation, please contact us. We always recommend discussing any potential changes, concerns, or ideas that you may have with a qualified financial professional prior to making any financial decisions so they can help you

Note: The views stated in this letter should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principles. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward-looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested in directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Sources: www.federalreserve.com; www.barrons.com; www.bls.com; www.forbes.com; www.cnn.com; www.bigcharts.com, Contents provided by The Academy of Preferred Financial Advisors, Inc.